So You’ve Been Named as the Executor, Now What?

Serving as an Executor (sometimes called a Personal Representative or Administrator) of an Estate doesn’t have to be a nightmare, but it’s important to be organized from the start.

As the Executor you are going to be the person who is legally responsible for protecting the assets of the decedent until the probate estate administration process has been completed and distribution can be made.

Typically, you won’t be liable is the estate drops in value during your administration as long as you’re acting in good faith. However, you could have a problem if you allow the assets to be tampered with or if you give away or allow assets to be sold for far below actual value. Keep in mind, you don’t have to serve as Executor if you don’t want to or are unable to do so.

Probate laws vary from state to state, but here are some fundamental steps an Executor should undertake:

1. Obtain the Death Certificates

The Executor is typically the individual who will be responsible for making the funeral and burial arrangements. One of the first questions that the funeral director will ask is how many death certificates you would like to order. The larger the estate and the more varied the assets the greater number of death certificates you are likely to need. We generally counsel our clients to get a minimum of 15 copies. Keep in mind, you can always order additional ones should it become necessary.

2. Locate the Decedent’s Last Will and Testament and/or Trust Documents

If you were named as the Executor, it’s likely that you already know where the Decedent kept his or her documents, but, if not, you’ll need to undertake a search for same. If you are not able to locate them in the Decedent’s residence, it’s possible that you may find them in a safe deposit box at a bank where the Decedent had accounts. Generally, you’ll need to find the original documents, although in some limited cases a copy of the documents will suffice.

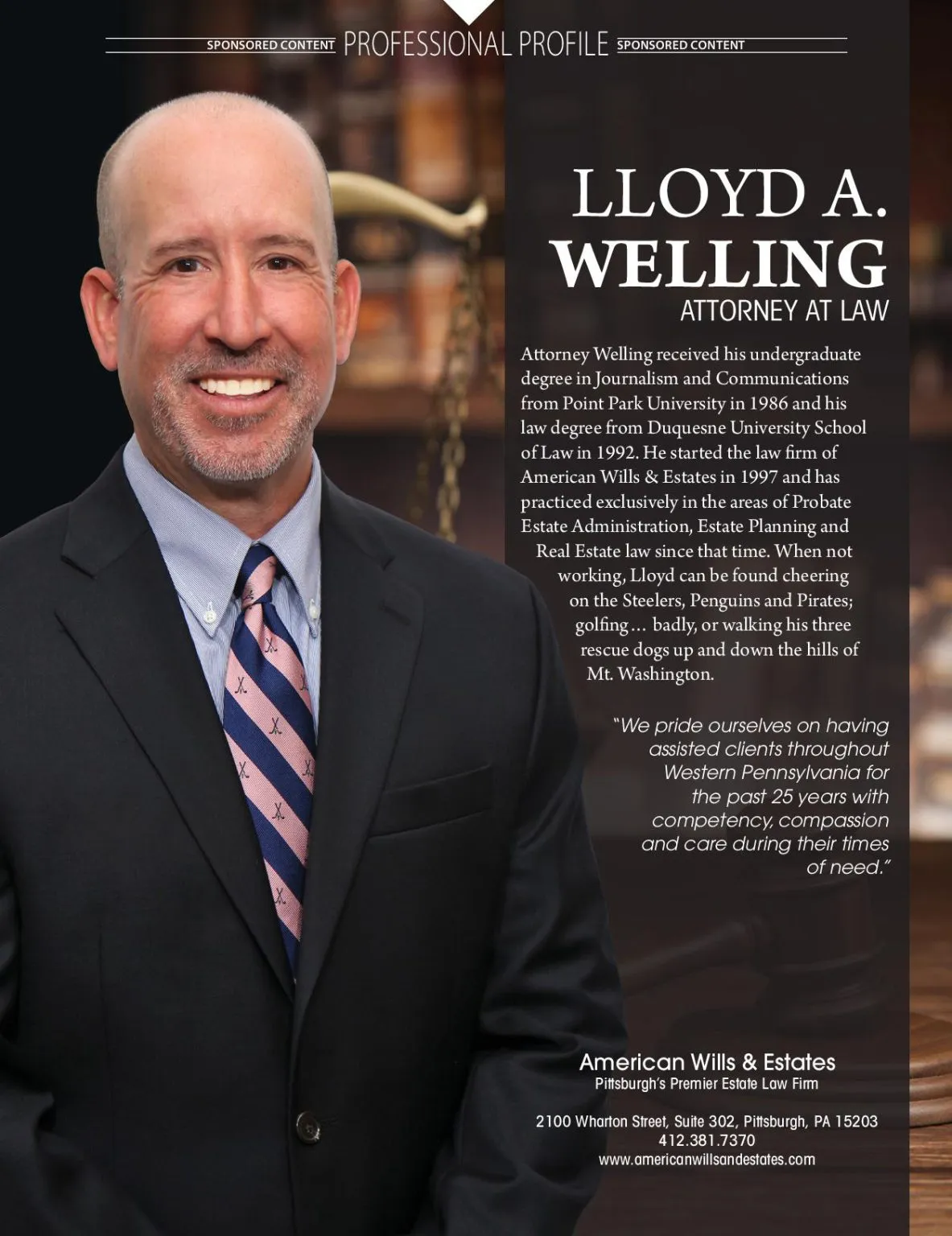

3. Seek Professional Guidance and Help

Once you’ve located the will and/or trust documents, you’ll start to get a better idea how straightforward or complicated the estate administration process is going to be. Before you start making any mistakes that could come back to haunt you, it’s probably a pretty darn good idea at this point to consult with and estate lawyer, accountant and other professionals that may be able to assist you with the process. Don’t start answering questions from the beneficiaries until you actually know what to say. Remember, the beneficiaries are generally just concerned with how soon they will get their inheritance. You, on the other hand, are going to be responsible for resolving all of the debts of the decedent before you are going to be able to make a distribution. Be careful, don’t start giving away estate assets until you’re sure that it’s not going to create problem later.

4. Open the Estate

Once it’s been determined that the estate will actually need to go through probate, keep in mind that the courts often look more favorably on an estate that is being opened by an attorney who is familiar with the process and actually knows what forms and documents will be needed to facilitate the matter. Generally speaking, if you try to undertake probate on your own, you’re asking for problems and the entire process will typically take much longer than it needs to. Once the estate has been opened, you will receive certified documentation from the court reflecting your legal authority to act on behalf of the estate. You will then be in a position to begin the process of paying bills, filing tax returns, gathering and distributing the assets, dealing with beneficiaries, and opening or closing bank and other investment accounts.

5. Marshall and Locate All of the Assets

The best gift a decedent can leave for an Executor a detailed list or accounting of what assets they have and where they can be found. A thorough list might include copies of the Wills and/or trust documents, copies of insurance policies and investment accounts, prearranged funeral plans, bank account information, deeds to any real property, business interests, and partnerships. Appraisals verifying the value of art, antiques or collectibles will also be of great help. But even if the decedent didn’t prepare such a listing, an experience attorney will be of great assistance in helping you track down and gather all of the different information and documentation that will be necessary. The attorney will also take care of the legal requirement of advertising the estate and notifying potential creditors.

6. Pay All the Bills and Depts Owed by the Estate

Remember, the estate is responsible for paying the decedent’s debts. If the debts outweigh the value of the assets, neither you nor the heirs will be liable for paying them. Still, before you start paying off any of the debts, it’s very important to determine whether or not the estate will be able to cover all of them. If not, the rights of the different creditors will be prioritized pursuant to state law. Again, if the decedent didn’t keep good records of their monthly bills and expenses, you’re going to be in charge of trying to figure it all out. Often, a very good place to start is with the decedent’s checkbook. The decedent’s financial statements and tax returns are also a very good source for gathering this type of information.

7. Don’t Try to Rush Through the Process

As the Executor, your natural inclination is going to be to try to keep everyone happy and distribute the assets to the beneficiaries as quickly as you possibly can. But if you rush through the estate administration process and miss some crucial or necessary legal step, you could be found personally liable for same. This is where having an experienced probate attorney who knows and is familiar with the local court rules can really help. A good attorney can also step in and help you resolve and disputes or arguments that may arise between the beneficiaries. Such fights, especially when there is a lot of money at stake, can get very nasty. To help you stay on the right track, keep good records and make sure you give copies of anything receive from a creditor to your attorney. Pace yourself and the process will not become over overwhelming.