Most folks typically don’t know a whole lot about the laws of Probate Estate Administration. They may know that it has something to do with what happens after a loved one dies, but not a whole lot beyond that. However, it’s a very good idea to educate yourself on at least some of the basics that are involved. Here are some of the more common misconceptions that people often have when it comes to the probate process.

1. If You Die Without a Will the State is Going to Take Everything

No, of course not. It’s still a very good idea to have a well drafted Will, but be concerned that the state is going to take all of your money if you don’t have one is not one of them. If you die without a Will you die intestate (just a legal term meaning no Will) and your estate will then pass in accordance with your state’s statutory laws which typically means to your closest living next of kin. That means your wife, your children, your grandchildren, etc. The only way your assets would actually pass to the state is if you die without a Will and leave no next of kin whatsoever. Still, if you want to control who your estate passes to and in what amounts or shares, you better have a Will.

Tip: Get an experienced attorney to draft your Will. It’s generally a very inexpensive process and it will allow you to control how and to whom your estate is ultimately distributed.

2. It Takes Forever to Probate an Estate

This is probably the single biggest probate misconception. People see stories on the news about a celebrity’s estate that was bogged in probate and estate litigation for years and assume that that is the norm. However, most estates are not complicated and can typically be probated from start to finish in a matter of a couple of months. Of course, it there is real estate involved that needs to be sold, or if the heirs and beneficiaries are fighting amongst themselves, the process can certainly be extended. Typically though, the only delay involved is making sure that the claims of any creditor of the estate have been resolved. When you see estate notices in the classified section of your local paper the purpose of those ads is primarily to notify potential creditors of the estate and to start the time period running for the time in which they are able to file their claims against the estate. Still, the vast majority of estates are administered within one year.

What can prolong the process and turn it into a nightmare? Family Fights. If the heirs and beneficiaries are fighting or if someone attempts to challenge or contest the Will, the probate process can become quite protract and the legal fees and expenses can mount quickly.

Large Estates. Very large estates may necessitate the filing of federal estate or state estate tax returns and can become much more complicated to administer. However, currently estates of individuals with assets under 5.45 million dollars are not subject to federal estate taxation. That means that 99.5% of all estates are not going to be subject to such federal taxation.

Estates With a Continuing Stream of Income. This takes us back to the celebrity type of estate where sometime dies, but income will potentially continue to come into the estate for years to come. Nice situation for both the families and lawyers involved in such matter, but again, extremely rare.

Tip: The heirs should avoid fighting at all costs and entering into any kind of estate litigation should be the course of last resort.

3. The Expense of Probate will Consume the Entire Estate

Simply not true. Attorney fees for handling estates are typically regulated by the state courts. Sure, we’ve all heard the scary stories of estate lawyers that charged a fortune or stole monies and assets from a decedent’s estate, but that is far from the norm. Typically, an experienced estate attorney will handle the probate process from start to finish for less than 5% of the value of the estate. Likewise, in most states the filing fees and expenses associated with probate are only a few hundred dollars. Be aware however that litigation fees can far exceed the standard fees associated with this process. More reason not to fight and to try your best to get along.

Tip: Find and experience estate attorney and make sure that he or she provides you with a written fee agreement that clearly and concisely spells out what your legal fees and cost and expenses are going to be.

4. I Can Cut my Spouse Out of my Will

Sometimes spouses decide not to leave each other anything in their respective Wills for a number of different reasons. Perhaps it is a second marriage for each of them and they have children from their previous relationships or, perhaps, they feel that they each have sufficient funds to take care of their own affairs. Whatever the reason, be aware that most states have laws that would allow a spouse who has been left out of their deceased spouse’s Will the right to take or “elect” against that individuals Will. State laws vary, but it is not uncommon for the spouse who files such an election to receive as much as one third (1/3) of the deceased spouse’s assets. Make sure you’ve discussed these kind of matter in detail with your spouse and with your children.

Tip: The only way to ensure against your surviving spouse being able to elect to take against your Will is to consult with an experience estate planning attorney beforehand. You’ll want to make sure that your spouse has signed a waiver promising not to take against your will or that the matter has been sufficiently addressed in some kind of pre or post nuptial agreement.

5. The Oldest Child Has to be the Executor

Of course not. Age doesn’t always equate with being the responsible. When you’re formulating your estate, you’ll want to pick the individual who will be most likely to follow your wishes and to carry out your estate plan as you intended. Keep in mind also that your Executor doesn’t have to be a single individual. You can always pick two or more of your children or other individuals to serve as your Co-Executors. But keep in mind, it might be a mistake if the two people you pick are prone to fighting with each other or really don’t get along with each other at all.

Tip: Pick the person(s) that you trust most. Don’t feel pressured into picking your Executor based on age or because you want to avoid hurting someone’s feelings. The administration of your estate is too important to let emotion prevail over logic.

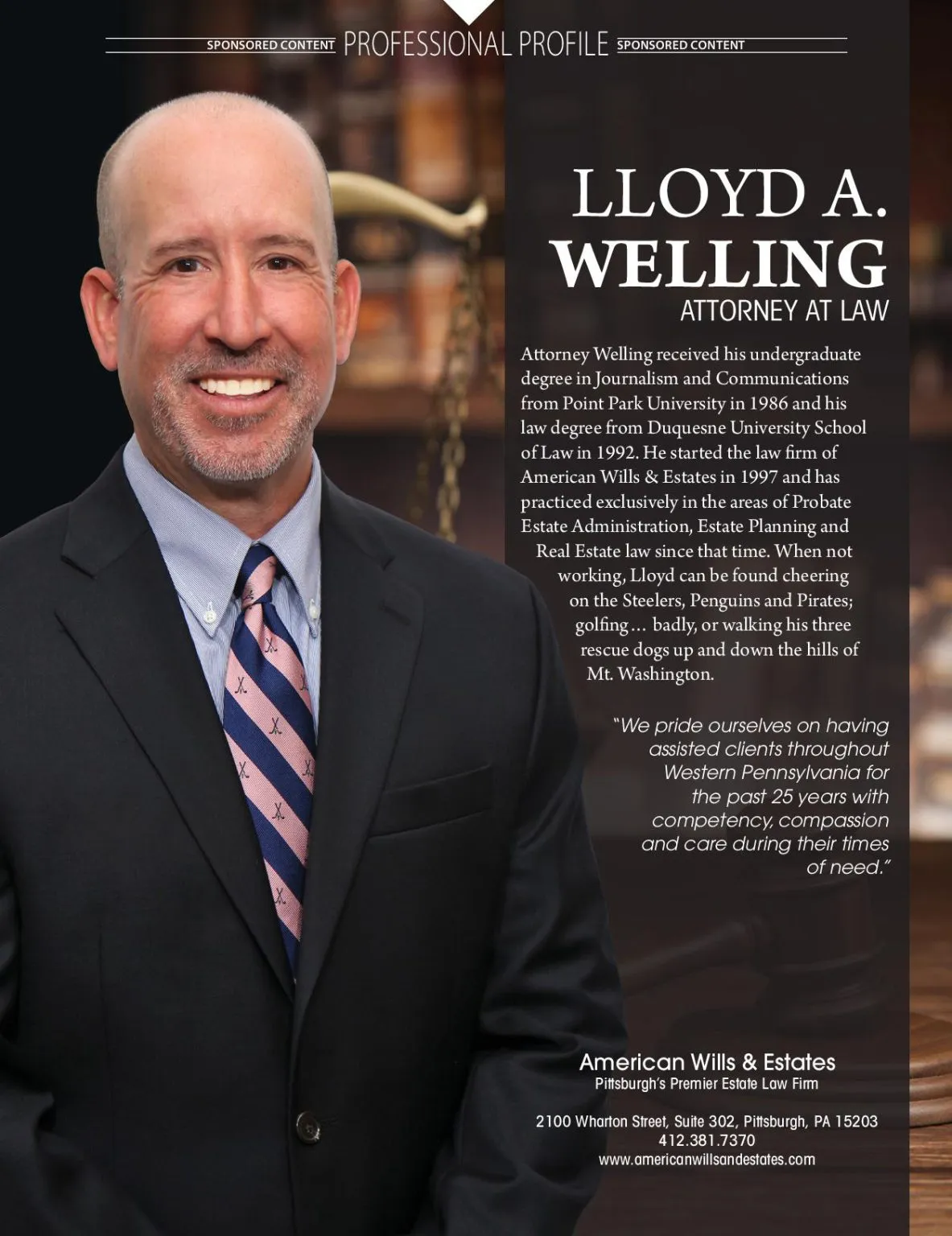

We hope you find this breakdown helpful. If you’re facing the prospect of probating a loved one’s estate and have questions concerning the process, please feel free to give us a call today. At American Wills & Estates, our attorneys have been assisting families throughout Western Pennsylvania through the probate estate administration process with competency, compassion and care for over 25 years. We offer free legal consultations and provide home, hospital and evening and weekend appointments upon request.

Call us today at (412) 381-7370 or visit us online at www.americanwillsandestates.com