Pennsylvania Probate and Estate Planning We’re Here to Help

Probate and Estate Planning Attorneys in Pittsburgh, PA.

Proudly Serving Western Pennsylvania

Topic: Wills, Estate Planning & Probate

Having a well drafted Last Will and Testament can go along ways toward eliminating many contentious and problematic issues that may arise after your death. Remember, giving your attorney concise instructions as to what you liked to accomplish in your estate plan will allows for the smoother administration of your estate later.

Making and probating a Last Will and Testament in Pennsylvania

In Pennsylvania, anyone 18 years of age and of sound mental capacity can make a will. Probate is a public process of validating or “proving” your will in courts after your death. During the probate estate administration process, your Executor (sometimes called your Personal Representative) will make sure that all of the just debts, expenses and taxes that may be owed by your estate are paid before proceeding with the distribution of your estate assets. In Pennsylvania, Probate takes place and occurs in the Orphans’Court of the county where the decedent resided at the time of his or her death.

Avoiding Probate in Pennsylvania

It’s generally a very good idea to set your estate up in a way where the probate process can either be avoided all together or minimized as much as possible for your heirs. A skilled Pennsylvania estate planning attorney can discuss the reasons to avoid probate with you. Some of the alternatives to probate include the following:

• Life insurance policies with designated beneficiaries

• Trusts

• Engaging in Gifting prior to death

• Transfer-on-Death (POD), Pay-on-Death (POD) or In-Trust-For (ITF) bank accounts

• Retirement plans and IRA accounts with designated beneficiaries

• Revocable Living Trust Planning

Things to bring to your attorney when drafting your Estate Plan

To avoid arguments and fights between your heirs and possible litigation after your death, it’s a very good idea to provide your attorney with as much documentation as possible when formulating your estate plan.

Put together a Comprehensive list of all of the property and assets that you own. Items that may be on your list include tangible and intangible assets such as the following:

• Household goods and personal effects, including furniture, clothes, jewelry, and other possessions

• Cars, boats, and other vehicles

• Bank accounts, including bank branches and locations

• Cash • Insurance policies, including policy numbers, beneficiaries, and contact information of the insurance company

• Stocks and other investments, including the name and phone number for any contact person

• Collectibles, memorabilia, and art

• Property such as your home, vacation or second homes, and rental units.

Instructions for Distribution of your Assets

Next to each item on your list, provide the name of your intended heir or beneficiary. It’s also a very good idea to provide your attorney with a detailed list of all of your outstanding debts and liabilities.

And remember, it’s always a very good idea to seek out and find experience legal help.

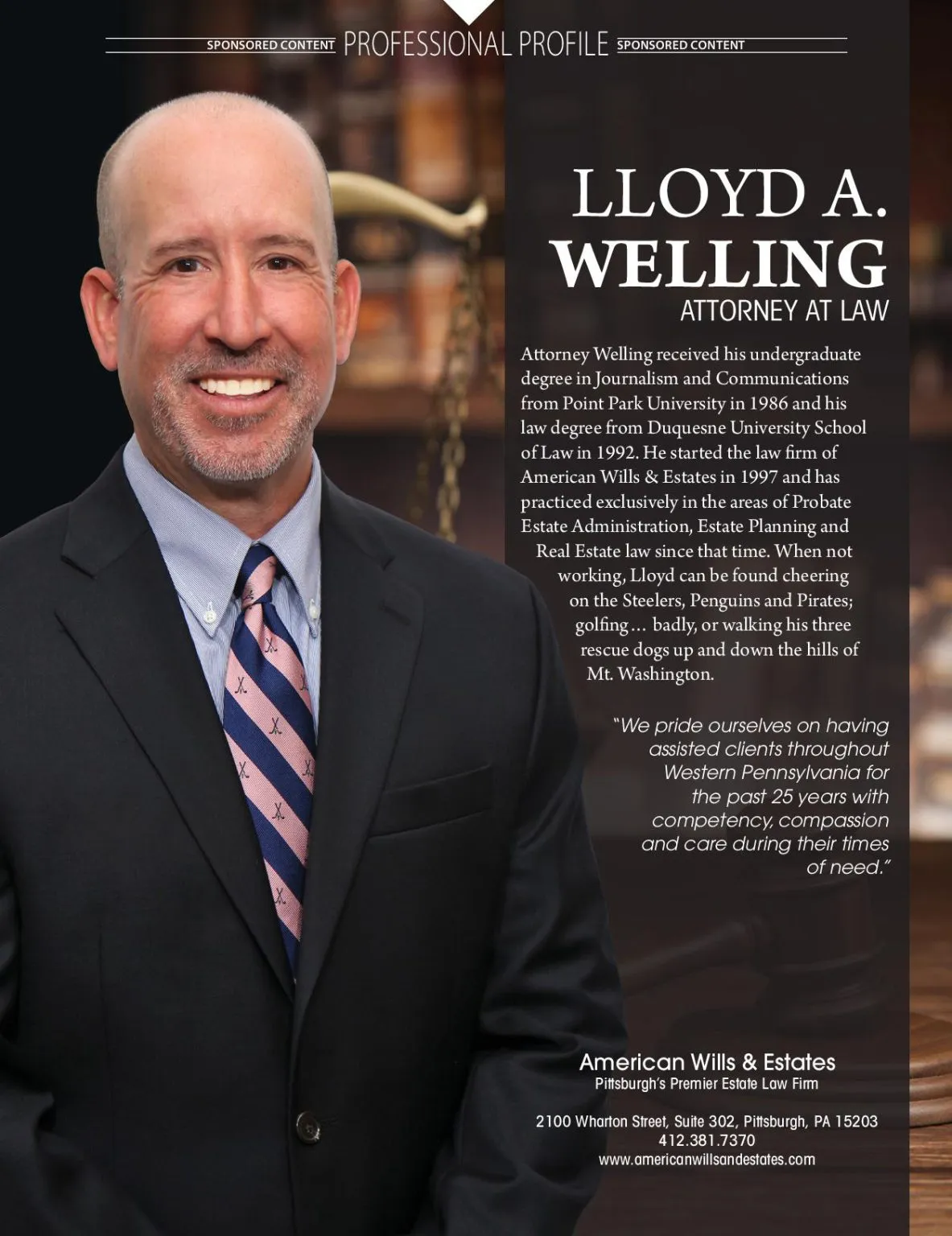

American Wills & Estates is here to help with all of your Estate Planning and Probate Estate Administration issues.

Contact us today to schedule your free legal consultation.

Seven convenient locations and home, hospital and evening and weekend appointments available upon request.

American Wills & Estates

2100 Wharton Street, Suite 302

Pittsburgh, PA 15203

1-877-293-5550

(412) 381-7370

www.americanwillsandestates.com