Having a clear and intelligent estate plan can bring you peace of mind and assure that your heirs will get the maximum benefit from what you have left behind. Here is list of 10 common estate planning errors that people often make. An eleventh mistake, and perhaps the worst mistake of all, is to have no estate plan at all!

Here is list of 10 common estate planning errors that people often make. An eleventh mistake, and perhaps the worst mistake of all, is to have no estate plan at all!

1. Improper use of jointly held property.

Owning everything jointly makes the provisions of one's Last Will and Testament null and void. Namely, property held jointly with the right of survivorship is left outright to the survivor. Frequently, an inequitable amount of property goes to a joint tenant because he or she receives the property directly even though the Decedent's Will may have called for a different division of the assets.

2. Improperly arranged or titled life insurance.

If the primary beneficiary of your life insurance policy is deceased, and you never took the steps necessary to name a secondary or contingent beneficiary(ies), your family could be in for a big problem. If your children are minors, and you haven't designated a trust to hold the life insurance proceeds until they reach a certain age, your insurance proceeds are subject to claims in the estate, and will pass through the estate. Likewise, your children would have full access and entitlement to these monies at the tender age of 18.

3. Lack of liquidity.

Not having enough cash readily available to cover funeral expenses, death and inheritance taxes and other final expenses is often a major concern for many families.

4. Choosing the wrong Executor or Personal Representative.

Often, the person designated to serve as the Executor or Personal Representative under a Decedent’s Will hasn't got the time, skill or knowledge to carry out the often long and drawn-out process of estate administration.

5. Will mistakes or errors.

All too often Wills do not get updated. People tend to draft wills when they get married or divorced, or when they have minor children. The Will often remains neglected for years after that. An incorrect will can pass property to an incorrect heir. Be careful.

6. Leaving everything to your spouse.

Depending on the size of your estate, there could be serious tax consequences involved in passing all of your property to your spouse. Leaving everything to a spouse isn't always the best way to proceed. Make sure you stay current with any changes in federal or state death or inheritance tax laws.

7. Improper disposition of assets.

This is when your assets get passed along to the wrong person. A 20-year-old, for instance might receive a larger amount of money than he or she is capable of handling. Inequitable distributions due to incorrect beneficiary designations can also be a major concern.

8. Failure to stabilize and maximize.

If you own a family business that is likely to survive and pass on to your heirs after your death, it's very important that you know, and record, the value of your business interest, and have an agreement in place that makes provisions for the business if you die. It's also important to make sure you've got primary and secondary beneficiary designations on all contracts—from pension plans to tax-deferred annuities. IRAs and other retirement vehicles often are a Decedent’s largest asset.

9. Lack of adequate records.

Where are your assets located? Do you have an updated list of the names and numbers of your closest advisors? Your Executor will need access to your most recent tax returns, the locations of all your bank accounts, information about insurance policies, and so forth. Make sure you record all relevant information and have it in an accessible location.

10. Not having a master plan.

You can learn everything you can about estate planning, but if you don't have a well-thought-out master plan, you'll still be at square one. Be sure to take the time once a year to quantify in dollar terms your financial needs and objectives, and chart a plan for reaching your goal in the most efficient and effective way.

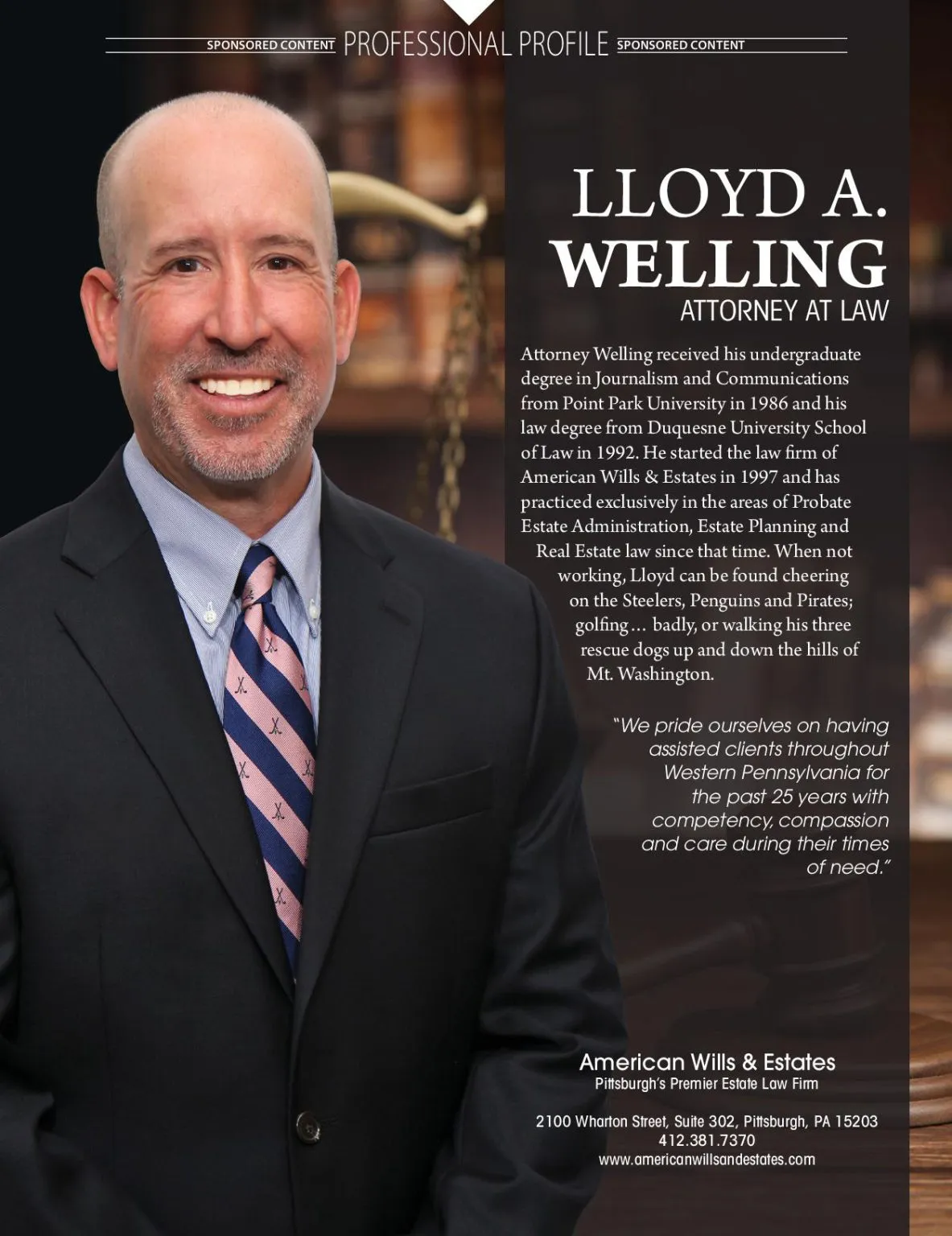

Having a clear and intelligent estate plan can bring you peace of mind and assure that your heirs will get the maximum benefit from what you have left behind. Estate planning is an extremely important and practical part of basic financial planning. It’s certainly not something to be avoided or ignored. Contact American Wills & Estates today to schedule your free, no cost legal consultation.