As if losing a love one wasn’t difficult enough, you now find yourself responsible for carrying out the administration of the estate. Sure, being named Executor is an honor and reflects the fact that the decedent had a lot of confidence in you to take on the role, but it’s also a whole lot of work and responsibility as well. Don’t think so? Take a look at just some of the steps that you’ll need to complete.

Steps for an Executor During Estate Administration

- Order and obtain the death certificates (How many will you need? Get at least 20)

- Copy the obituary & death notices for further proof of death if necessary

- Determine if the decedent had a safe deposit box

- Put together a comprehensive list of heirs, next of kin and beneficiaries

- Make copies of the decedent’s marriage, birth certificate and military records if applicable

- Locate the original will

- Meet with and hire a trusted, experienced estate attorney

- Formally open the estate and begin the probate process

- Proceed with probate filing and determine if any trusts were created or will be involved

- Determine if the decedent had life insurance and locate the policies

- If there is real estate involved, locate the deeds, mortgages, leases, and other property information

- Secure and take possession of all of the decedent’s personal tangible property including, but not limited to, cars, trucks, boats, recreational vehicles, mobile homes, motorcycles, furniture, fine jewelry, art and other household contents and effects

- Secure and take possession of all of the paperwork related to the decedent’s financial assets including, but not limited to, stocks, bonds, bank accounts, IRAs, CDs, cash, mortgages, notes, pensions, life insurance, etc

- Begin the process of fling insurance claims and obtaining distribution of same

- Determine if there are retirement benefits, annuities, pensions and other financial accounts that will need to be liquidated and distributed

- If possible, get copies of the past several years of the decedent’s state and federal income tax returns

- Stop Social Security payments and determine if any such death benefits are still payable to the estate

- If the decedent was a veteran, file for any burial benefits and survivor benefits that may be available

- Open an estate bank

- Collect any debts and/or other accounts receivable due or payable to the decedent

- Notify Medicare of the death

- Notify the banks where the decedent had accounts of the death

- Notify any stock and/or brokerage account of the death; and transfer ownership of jointly or solely owned stocks, bonds and mutual funds

- Notify credit card companies and close out and cancel all credit cards

- Notify any and all other potential creditors of the decedent’s estate

- Determine the priority and order in which the decedent’s creditors should be paid

- Sell or transfer title to any automobiles the decedent owned

- Pass jointly owned assets to the appropriate survivors

- Transfer bank accounts and securities to the appropriate surviving joint owners

- Transfer retirement and investment plans to the appropriate designated beneficiaries

- If the decedent owned a business, arrange for the sale, transfer or dissolution of same

- If the decedent was receiving royalties, arrange for the continued management of same and ongoing sales

- If the decedent owned rental properties, arrange for management of the ongoing rents; rental properties, both in- and out-of-state, as appropriate

- If necessary, terminate leases and outstanding contracts of the deceased

- Arrange for the continuing payment of expenses, such as mortgage payments, utility bills, and homeowner’s insurance premiums, until the decedent’s home and other real property is sold

- Notify decedent’s accountant, bookkeeper and/or tax preparer of the death and arrange for the preparation and filing of final state and federal income tax returns

- Prepare and file an estate tax return for estate taxes, or any state inheritance return, if necessary

- Determine whether the estate qualifies for “special use valuation” under the tax laws (IRC § 2032A), deferral of estate taxes (IRC §§ 6161 or 6166), etc

- Pay any federal or state taxes that may be due

- Keep detailed records of all receipts and disbursements made on behalf of the estate, including attorneys’ fees and executor’s fees

- Keep detailed records of time spent and activities conducted on behalf of the estate during the administration of the estate

- When debts and taxes have been paid and all the property distributed to the beneficiaries, the estate may be formally closed by the probate court

The Estate Administration Process can be Overwhelming

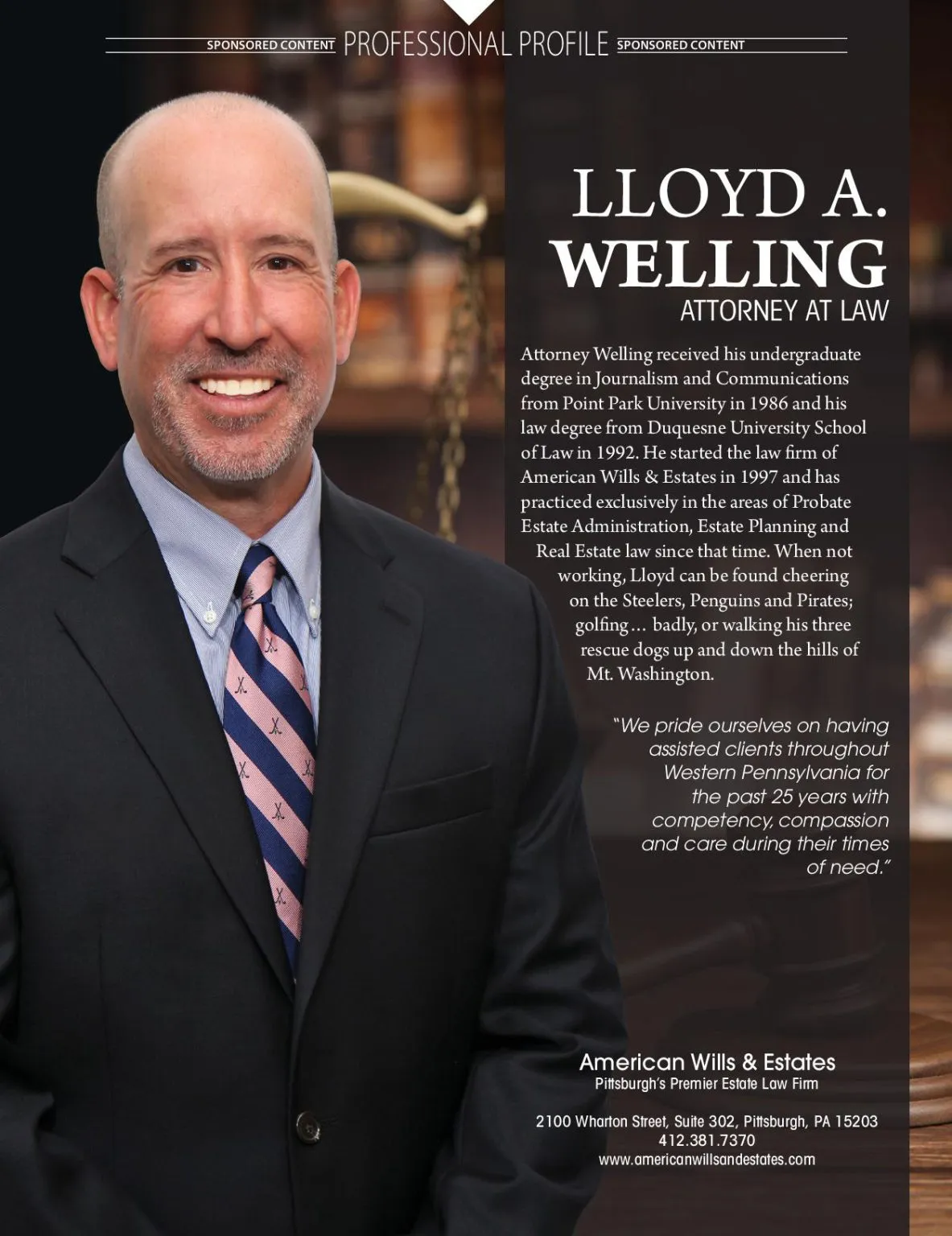

Feeling nervous yet? You should be. As you can see there is going to be a whole lot of work involved and the real potential for mistakes to be made. Do yourself a big favor at the outset and make sure that you hire an experienced and reputable estate attorney to help you with this process.

At American Wills & Estates we’ve been guiding clients throughout Western Pennsylvania through the probate estate administration process with competency, compassion and care for over 25 years. We handle the majority of the estates that we administer each year on a flat fee basis and provide all of our potential clients with a comprehensive free legal consultation. Give us a call today at 412-381-7370 or visit our law firm online at www.americanwillsandestates.com You’ll be glad you did.