WHY A HANDWRITTEN WILL IS A VERY BAD IDEA

A handwritten Will is known as a holographic will and are typically valid provided they comply with a state’s statutory laws. Thus, the old adage that you could write your Will on a napkin and it would be perfectly legal. Legal? Perhaps. A good idea? Probably not. Many folks may like the idea saying exactly what they want to say in their wills and may feel that their situations are simple enough to do it on their own. However, there are many good reasons why writing your own will is a bad idea.

Ambiguities and Mistakes. Probably the single biggest problem with handwritten wills is the potential for ambiguity. The person writing the will may have thought that he or she was being perfectly clear and concise, but those left reading the document may be left with a great deal of confusion as to what their loved one actually meant or intended. Common types of ambiguity are where someone is referred to in the will only by a first name or by a nickname, i.e. my cousin, Bob; my friend, Joe. Problems can quickly arise when there are in fact two cousins named Robert or two friends named Joseph. Likewise, we see this seem kind of problems when gifts are made for a charity, but the intended charity is not clearly defined and set forth adequately in the document.

Failure to Dispose of the Whole Estate. A lot of times, handwritten document will specify certain specific gifts or assets, i.e. my house, my car, my bank account, etc. While that’s okay, problems can arise when the document doesn’t address other assets or fails to give away all of the person’s estate. For example, if you say you’re giving your house to a particular individual is that person also to receive all of the personal and household effects located there as well? Likewise, what happens when you fail to mention stock or other accounts that you may still own at the time of your death? If it’s determined that the handwritten will doesn’t really address certain things, then those assets will end up passing pursuant to the state’s intestate (fancy word for without a will) laws. As such, they may end up going to someone other than who may have actually intended. Another really big problem can occur when a person leaves certain specified dollar amounts to a number of different individuals. If the estate ends up not being large enough to satisfy these types of bequests, only a few of the intended heirs and beneficiaries may actually get anything.

The Problem of “Ademption”. Ademption, is a common law doctrine used to determine what happens when property left in a will either no longer exists or is no longer a part of the person’s estate at the time of their death. When this happens, it may very well mean that the heir who was intended to get such asset may very well end up getting nothing at all. For instances, a parent may have specified that one of their children was to get the house and was therefore not to receive anything else from the estate. If the house is later sold by the parents during their lifetimes and their handwritten wills are never changed, that child may end up getting nothing even though the parents likely would have never wanted such a result. Same type of thing can happen with bank accounts or stocks that were specifically left to a particular child, but then later sold by the parents.

Failure to Name or Designate a Contingent Beneficiaries. The persons you name in your will to receive your assets are called “beneficiaries.” Often times someone writing their own will fails to consider the possibility that a particular beneficiary they have designated might die before them. If that happens and no alternate beneficiary was the named, then the original gift will “lapse,” meaning it will pass according statutory law. For example, if you left part of your estate to one of your children, but that child dies before you do, you may want that child’s share to pass instead to his or her children (your grandchildren). However, if you have not used the proper language in your will, that child’s share might pass instead to your other living children.

Failure to Designate a Personal Representative. Those writing their own wills often focus only on how their assets are to be divided, but fail entirely to designate who will be in charge of carrying out their actual wishes. If no Personal Representative is named in the will, the court will typically end up appointing an “administrator” to handle the estate. The person appointed by the court might be someone whom the testator would not have chosen. Even in those handwritten wills where a Personal Representative has been named, the issue of whether or not such person would be required to post a bond is usually not addressed. Posting a bond cost money and can also further complicate the initial steps that a Personal Representative will need to taken in order to administer the estate.

Failure to Address Special Circumstances or Needs. If one of your intended beneficiaries is disabled and receiving some type of government benefits, they may lose such benefits if they receive a direct inheritance. Likewise, if one of your children has a substance abuse problem or is prone to making bad decisions, an outright inheritance might not be the best way to go. Finally, if one of your beneficiaries is still a minor (under 18), it may be necessary that they receive their inheritance in the form of a trust of some kind. A handwritten will is simply not appropriate for these kind of situations.

Failure to Name Guardians. When minor children are involved, a will must include carefully thought out provisions concerning the appointment of guardians and also spelling out how and when the assets are to be distributed to them. If no guardian has been named in the will, the court will appoint someone to serve in that role. That person may be the last person in the world you would have selected to have custody and control over your minor children.

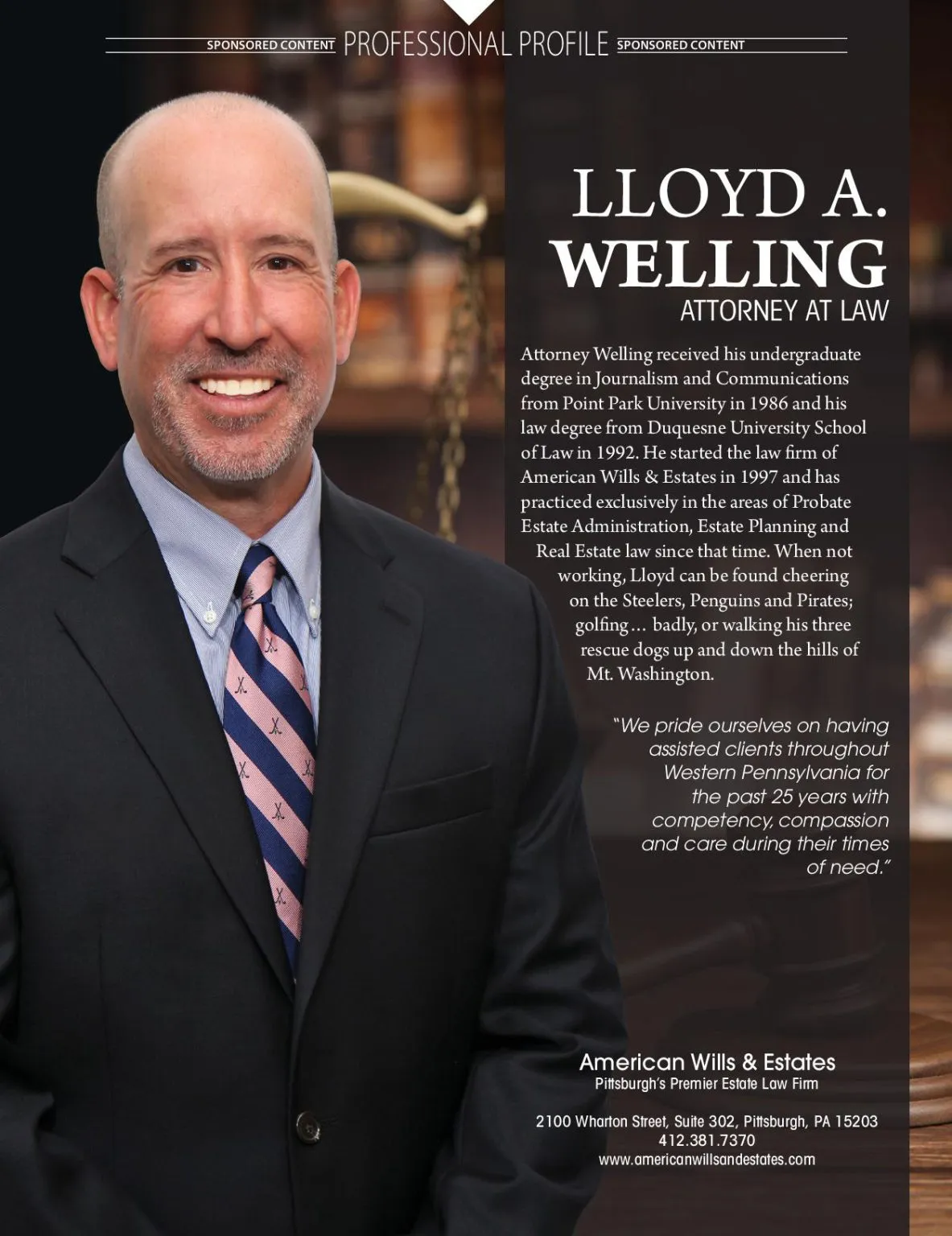

If you still want to write you own will, it’s your legal right to do so, but please consider the many risks you’re taking. If saving money is your primary concern, you’ll be happy to learn that having an attorney prepare your will is typically a simple and inexpensive undertaking.