Being named as the Executor of your loved one’s estate is certainly an honor, but it’s also a whole lot of work. It’s pretty easy to get overwhelmed by the whole process, but here simple things to keep in mind to keep you on the right track.

Organize and Set Aside Space for all of the Estate Documents

The probate estate administration process is a paperwork intensive one. The more organized you are the less stress you will have. Keep all of the estate documentation, i.e. bills, account information, deeds, etc. separate and apart from the rest of your day-to-day paperwork and other affairs. It doesn’t have to be anything fancy, but set aside a space where you can easily find what you’re looking for as the administration process begins to move forward.

Order Enough Death Certificates

You’ll probably need far more of these than you might think. The death certificate provides proof of the death and you’ll find you need one when dealing with the banks, investment and insurance companies, hospital, pension administrators, etc. I always tell my clients to have the funeral home order them a minimum of twenty (20 certificates. You can always get more if you need them, but sometimes that process can become burdensome and extremely inconvenient if you need to get something done in a hurry.

Hire the Right Professionals

Unless you have a legal and/or accounting background, the first thing you’re going to want to do is speak with and retain an experienced estate attorney and tax professional to guide and assist you through the estate administration process. Remember this, in taking on the role of Executor you are also taking on the legal responsibilities and liabilities that come with it. If you make mistakes, you could get yourself in trouble pretty quickly. Seek out the right advice and counsel at the start and the whole process should go a lot smoother.

Locate and Take Possession of the Will

In order to be formally sworn in and appointed as the Executor, you will need to present the original Will to the probate court in the county in which your loved one resided. Often times what you think is the original Will might only be a copy of the original document. As such, once you have located the Will it’s a very good idea to have an estate attorney review it to determine both if it’s the original and also whether or not it’s what we call a self-proving document.

Get Appointed and Obtain Short Certificates or Letters Testamentary

Once you’ve determined that the Will is valid, the next step will be to get sworn in and formally appointed to the role of Executor. It’s important to do this in a timely manner because the estate administration process is a procedurally driven time-sensitive one. Typically estate and inheritance tax returns will have to be prepared and filed within a certain time frame following the decedent’s death. The longer you procrastinate in getting the process started, the more likely you will be to be late or miss altogether a tax filing deadline. Just like with the death certificates, it’s probably a good idea to obtain a number of short certificates (Letters Testamentary) from the probate court because, depending on the size of the estate, you may find that you will need a number of them during the probate process.

Marshall and Protect Estate Assets

This is going to be your most important and number one responsibility. Make sure you take control of any and all of the decedent’s assets. You may be the most honest person in the world, but you’d be surprised how fast the other heirs may turn on you if they feel as though you are not providing a accurate accounting of the overall estate assets. The easiest way to go about this to establish and estate bank account at the beginning of the administration process and then to go about liquidating and systematically transferring all of the decedent’s other assets into it. Obviously, not everything that the decedent owned is going to end up in an estate bank account. You’ll also need to also take control and possession of all of their miscellaneous personal effects and household effects as well. You’d be surprised how fast arguments can start over small things with little or no real value. Better to be safe than sorry. Don’t start giving away stuff until all of the heirs have been consulted.

Remember Not All Creditors are Created Equal

Don’t just assume that all of your loved one’s bills and liabilities will have to be paid as soon as possible. As a matter of law, certain creditors of an estate are given priority over other ones. Some debts like taxes or secured loans are entitled to be paid before others. This can be extremely important if you are administering an estate that may not have enough assets to satisfy all of the creditors. Make sure you discuss all debts with your estate attorney before you just start sending out payments.

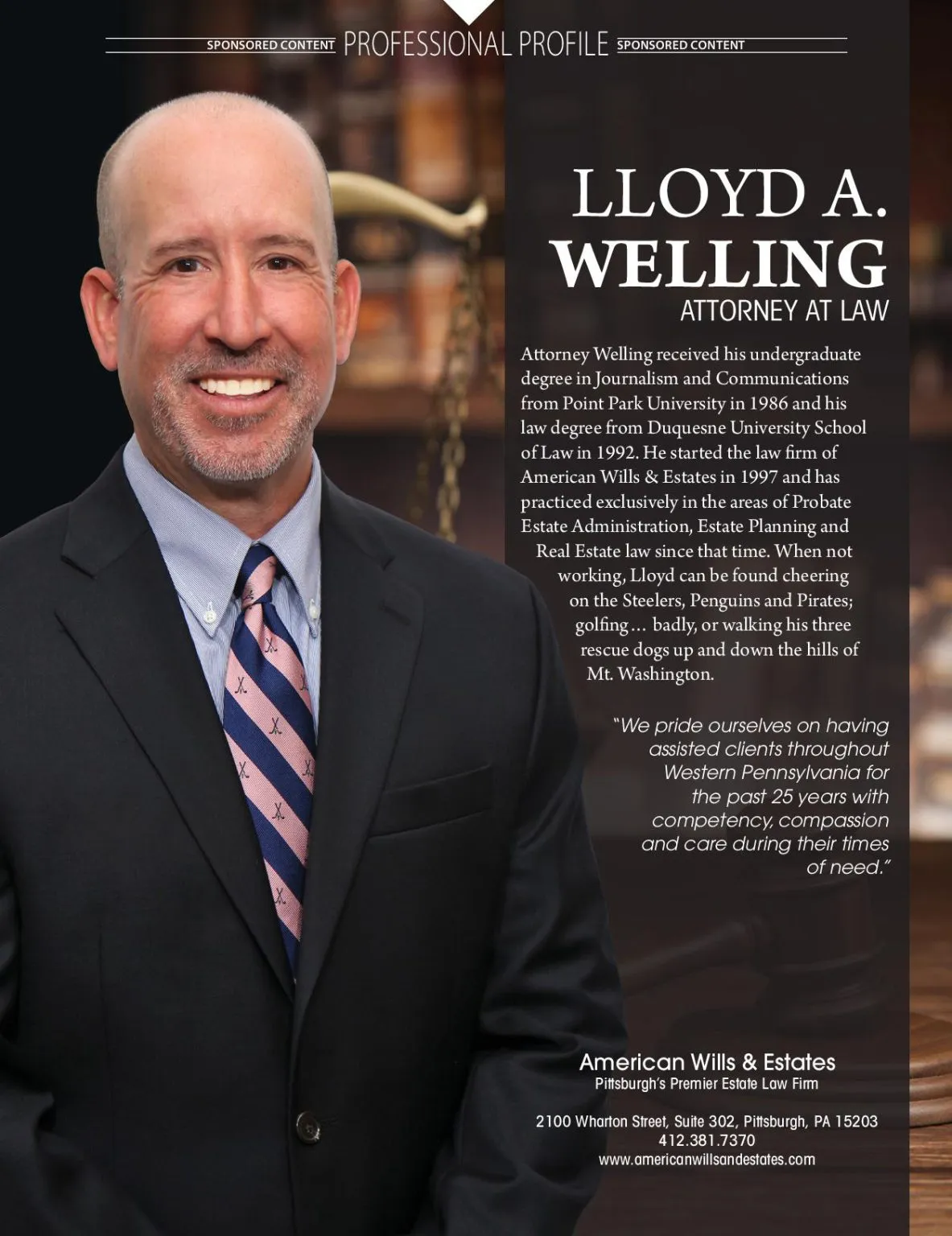

American Wills & Estates is a locally founded, owned and operated law firm that has been guiding clients in Pittsburgh and throughout Western Pennsylvania through the probate estate administration process with competency, compassion and care for over 26 years. So, if you’ve recent lost a loved one and are not sure where to turn for trusted and experience legal help, give us a call today at (412) 381-7370 or visit our law firm online. You’ll be glad you did.