It’s certainly an honor to be named as a loved one’s Executor, but it can also be a whole lot of work. Your job is to protect all of the decedent’s assets until all of their funeral and burial expenses, debts, income taxes and inheritance taxes have been fully paid and resolved. You will then need to ensure that the decedent’s remaining assets are ultimately distributed to those individuals whom he or she had intended.

The law does not require you to be a financial professional, but, remember, you will have a fiduciary duty to make sure that the estate is resolved in an honest, impartial and straightforward manner. If you breach this duty, you could be held personally liable by both the creditors and beneficiaries of the estate for any errors or mistakes that you make during the probate process.

Here’s a basic breakdown of some of the primary obligations that you will have:

- Find, manage and protect all of the Decedent’s assets until they can be distributed

- Determine whether formal Probate proceedings will be required (remember laws vary by state)

- Determine who the heirs and beneficiaries are (make a list of names, addresses & telephone numbers)

- If there is a Will, find it, make copies of it and secure and protect the original

- Secure credit cards, notify banks, the post office and agencies such as the Social Security, Medicare, and the V.A. of the death

- If probate is required, open the estate and establish and set up the estate bank account (you’re most likely going to need and estate lawyer to assist you through the probate estate administration process

- Use the estate account to pay the ongoing expenses of the estate pending the administration process (don’t mix your own monies or other non-probate monies into the estate account, this can result in big problems later on)

- Notify creditors and begin to resolve any debts that the decedent may have had (be careful here because not all creditors are treated equally, this is where a qualified estate attorney can really help you out)

- Pay the income tax and inheritance and estate tax obligations of the estate (again, be very careful, get expert legal advice to ensure that tax mistakes aren’t made); and Make distribution of the assets and secure either a family settlement agreement or court approval and authorization before doing so

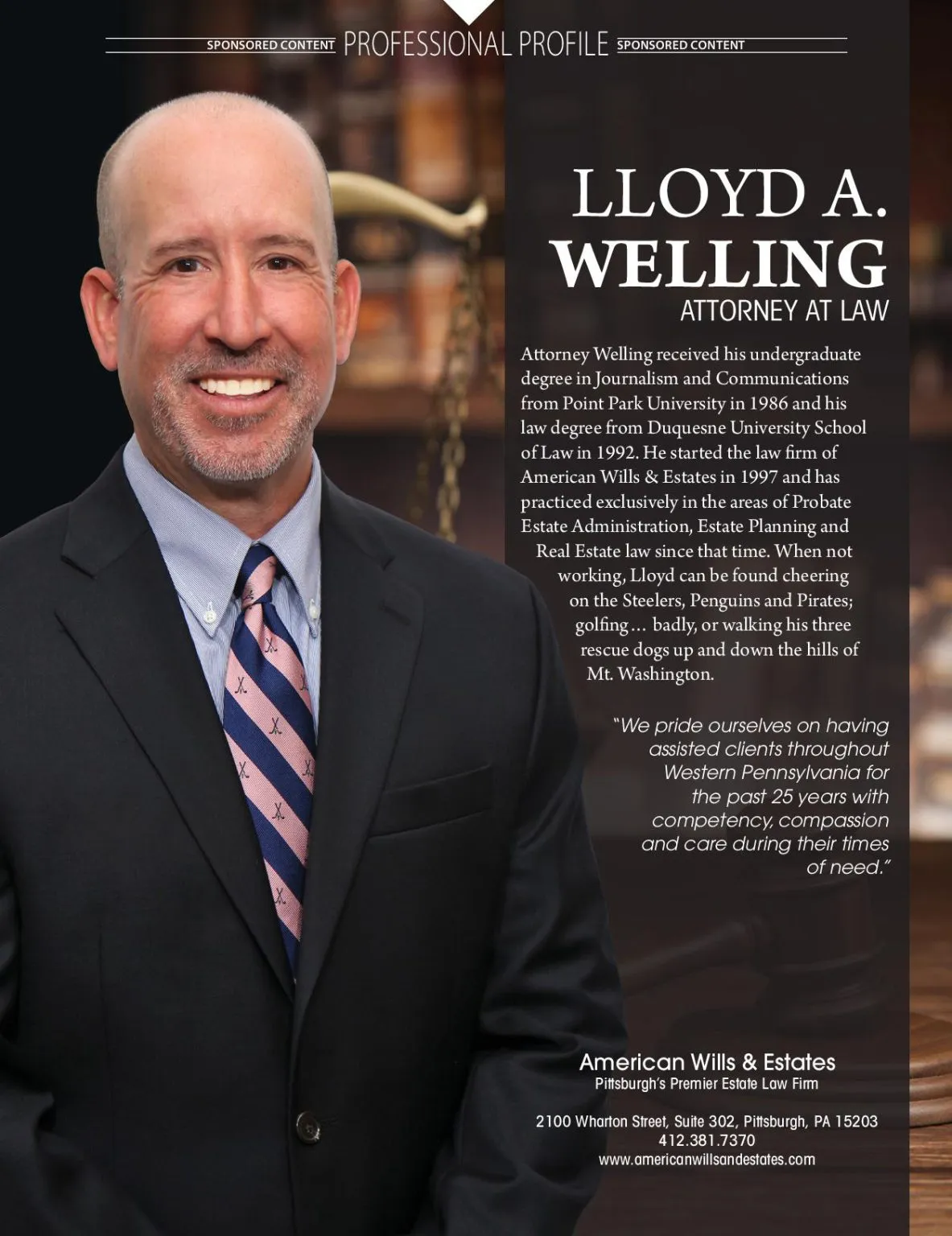

If you’ve recently lost a loved one and are feeling overwhelmed by the whole probate estate administration process, we’re here to help. American Wills & Estates has been guiding clients in Pittsburgh and throughout Western Pennsylvania through the probate process with competency, compassion and care for over 25 years. We offer all prospective clients a free legal consultation and we provide the majority of our estate administration services on a flat fee basis. Give us a call today at 412-381-7370 to schedule your free legal consultation or visit our law firm online at www.americanwillsandestates.com You’ll be glad you did.