If you’ve recently lost a loved one and suddenly find yourself in need of an estate attorney to guide you through the probate process, make sure that you know what you’re getting into before you sign the fee agreement.

Probably the most common way estate attorneys charge is by basing their fees on a percentage of the total value of the estate that they will be administering. While a five (5%) percent fee might sound pretty reasonable at first, it might seem a lot less so if the estate is worth a million dollars but consists of little more than one or two investment accounts. Suddenly, that five percent fee is translating into a $50,000 dollar legal fee for simply processing a couple of accounts, filing an estate or inheritance tax return and distributing the proceeds to the heirs. On the other hand, if that same estate is comprised of multiple pieces of property that will need to be sold, multiple bank and investment accounts, and there are a large group of heirs and beneficiaries who don’t necessarily get along, then that five percent fee might not seem so bad.

Some estate attorneys will propose that they’ll handle the estate administration process based on an hourly fee arrangement. Of course, the problem with this kind of arrangement is that you’ll quite literally have no idea how much you’re going to end up paying until you get to the very end of the process. Two Hundred dollars an hour for the attorney might seem okay at first, but when you find out that you’re also quite likely paying separately hourly rates for those services that are to be provided by the paralegal, secretary, accountant and other staff members of the law firm, this type of arrangement can get very expensive very quickly.

So what the heck are you to do? It’s simple really, find an estate attorney who is willing to handle the estate administration process based on a flat fee arrangement. Moreover, make sure that they don’t expect to be paid until the probate process has been completed and that they require only a small retainer of front to cover the out-of-pocket costs, expenses and filing fees that will be incurred. Remember also that a flat fee arrangement doesn’t mean that every estate will be handled for precisely the same cost, it simply means that you’ll know what you’re going to pay upfront for the services that are to be provided.

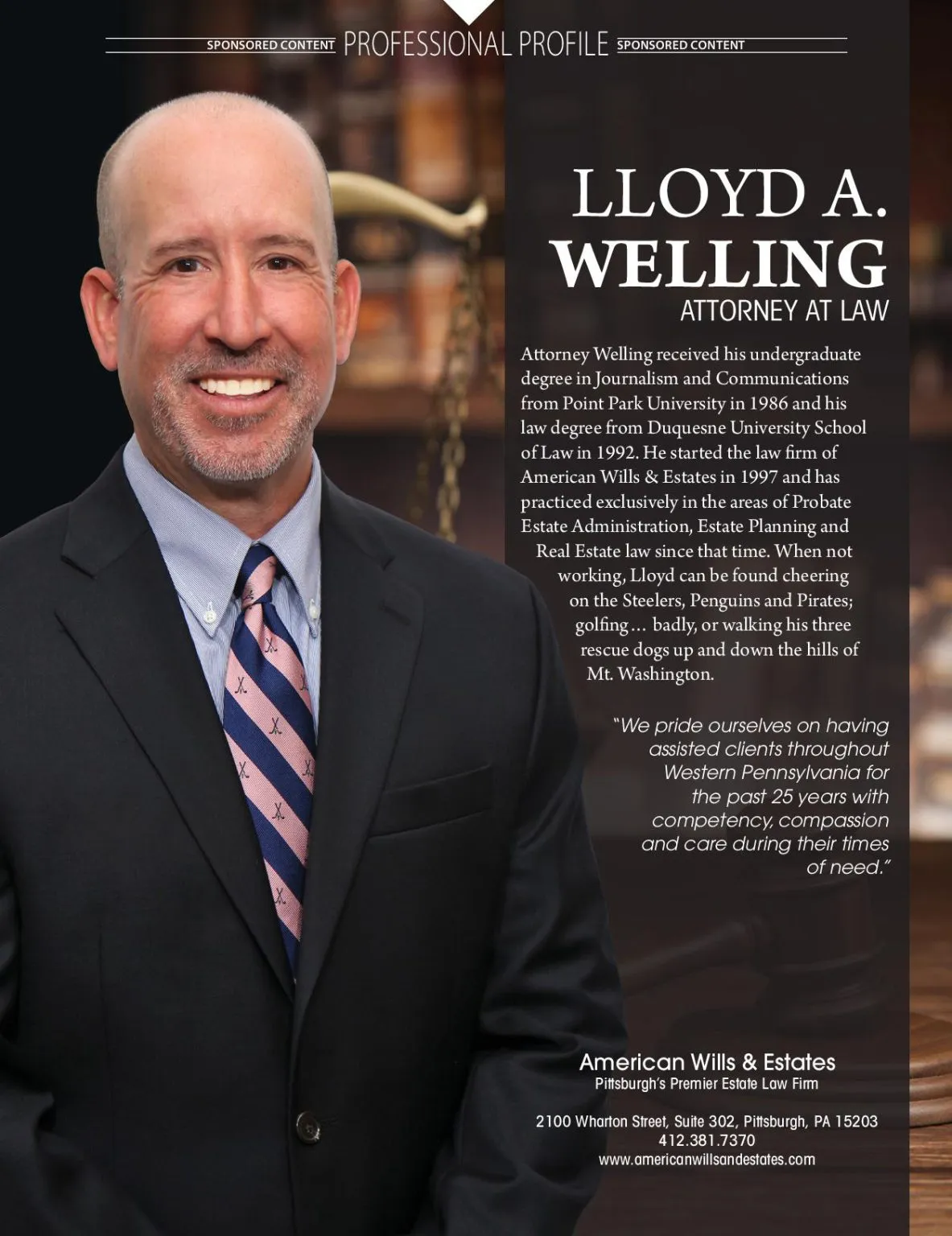

American Wills & Estates is a locally founded, owned and operated Pittsburgh law firm with a practice limited to Probate Estate Administration, Estate Planning and Real Estate law. We’re the #1 rated Probate Estate Administration and Estate Planning law firm in Pittsburgh and throughout Western Pennsylvania. We’re also Pittsburgh’s top Wills Attorneys. Contact us to speak with an Estate Planning lawyer and to learn how we help make the process easier.

Unlike the vast majority of Estate law firms, we offer most of our Probate Estate Administration and Executor assistance services on an affordable flat fee basis. We also do not expect to be paid for our services until the estate administration process has been completed. Our Estate Attorneys will ensure that you’ll know precisely what you’re going to pay in advance and you’ll have our fee agreement in writing.

So, if you’ve been named as the Executor or Personal Representative of a loved one’s estate and are not sure where to turn for trusted, experienced and affordable legal assistance, give us a call today at (412) 381-7370 to schedule your free consultation or visit our law firm online. You’ll be glad you did!