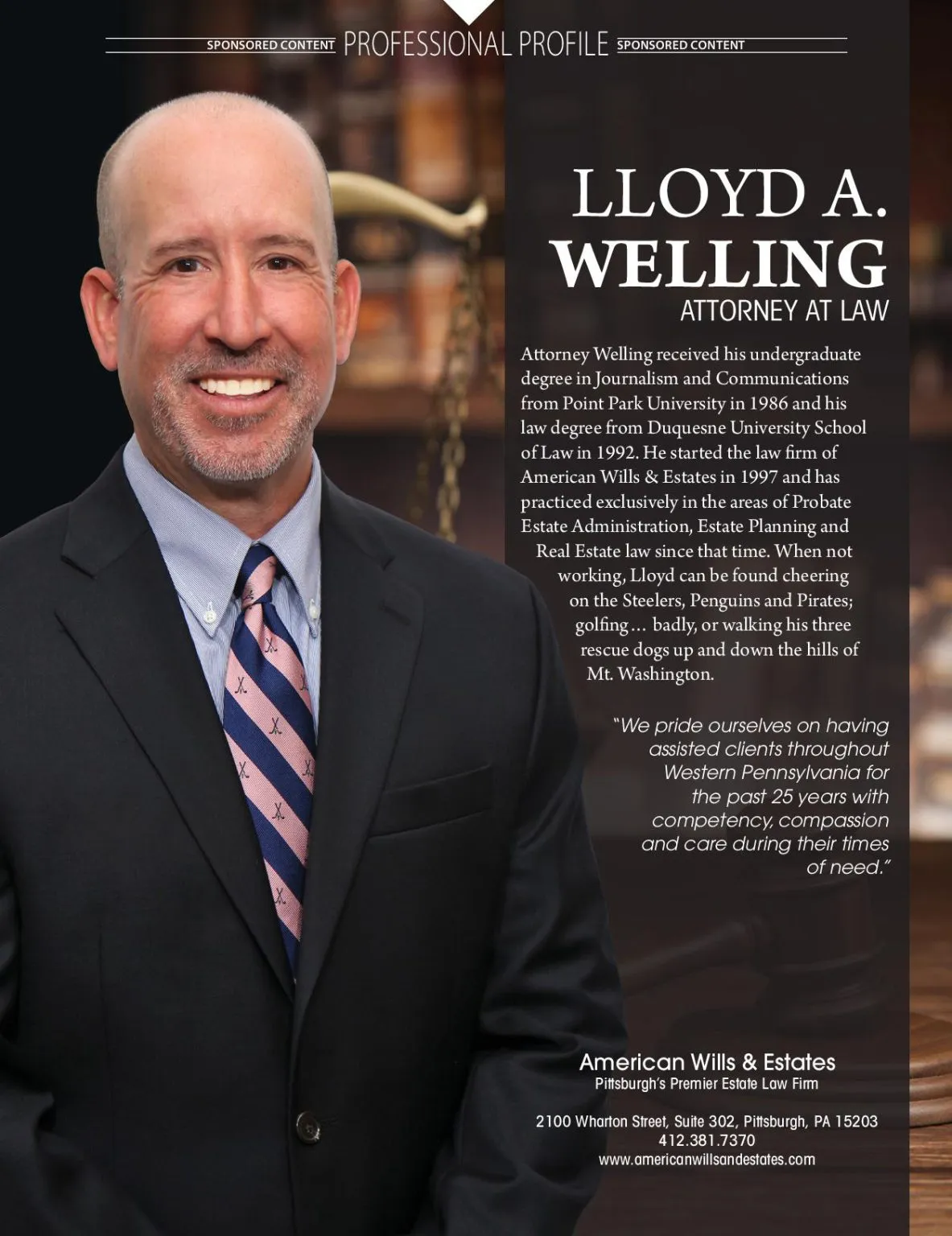

Make sure your Estate Plan is up to date. Do you have a current Will, Power of Attorney and Living Will? How have recent changes in the law effected your Estate Plan? What is the difference between a Will and a Revocable Living Trust? To get answers to these and many of the other estate planning or estate administration questions that you may have, give us a call today. At American Wills & Estates we have been taking care of all of our clients estate planning needs with competency, compassion and care for over 25 years.

1. Anticipate a time when you may not be able to think or act for yourself.

2. Review and update you current estate plan.

If you haven’t reviewed or revised your current estate plan in 5 or 10 years, make sure that it still reflects your present intentions and that it is flexible enough to address any changes that have taken place in the estate and inheritance tax laws. Remember, it is not at all uncommon for a person to change, modify or revise their estate plan several times during their lifetime. It is very important to keep your estate planning documents current and up to date.

3. Choose a guardian for children who are minors or who have special needs.

Few prospects are more wrenching than the possibility that young children will be orphaned. Often, parents put off writing a will because this particular thought is unbearable or couples cannot agree on a potential guardian. Some assume–incorrectly–that it is enough just to ask a relative or trusted friend to step in if the need arises. If you have not already outlined your wishes in a will as to who would be the guardian(s) of your children in the event of your death, it is vital that you do so.

4. Review beneficiary forms.

Retirement accounts are distributed according to beneficiary designation forms filed with the bank or financial institution (the custodian) holding your account. With an IRA, you can readily name any beneficiaries you want, including friends, family members, a trust or charity. To change a beneficiary, you will need to file an amended change of beneficiary form. Make sure to name both primary and contingent beneficiaries. It’s also a very good idea to get written confirmation from the custodian that they have actually made the changes that you requested.

5. Make sure there’s money in the bank.

Couples who commingle money should make sure there is enough to cover immediate expenses if one of them suddenly passes away. These funds can be held in each of your separate accounts or in a joint one. Just be aware that when you die, your spouse or partner will probably not have access to your individual account right away. A better approach is to maintain a joint account designated for emergencies that can also be available for this purpose.

6. Consider whether to give away assets now to save taxes.

In 2016 the federal estate tax exclusion will be $5.45 million per individual or $10.90 million per married couple. As such, the current federal estate tax rates will effect and concern very few people. But what if the exemption goes down? If you’ve got more than enough money for retirement, you can hedge your bets by transferring some now. Just keep in mind that most methods of saving estate taxes require you to totally give up ownership and control over assets, whether you are giving them to people directly or putting them into a trust. A threshold question for anyone contemplating this type of strategy is: Can I afford it? Be sure you are leaving yourself enough, and to be on the safe side, you should assume you will live to an advanced age.

7. Determine whether a Roth conversion is appropriate.

In this maneuver you take money out of a pretax IRA, pay tax on it and plop it into a Roth, where it can grow tax free. With Roth you avoid the requirement to take yearly minimum distributions starting at age 70½, and that can leave more for beneficiaries if you don’t use the money yourself.

8. Consider whether you might need a trust.

You may think that trusts are just for the very wealthy, but, in fact, they can be enormously useful even for people of more modest means. In numerous situations, a trust may be the best way for you to achieve your estate planning goals. Whether taxes are a concern or not, you can use a trust to:

- Safeguard your assets

- Avoid probate

- Shelter assets left to a spouse who is not a U.S. citizen

- Provide for children from a previous marriage

- Hold money for minors and ensure that they can’t spend it all at once

- Prevent funds from being eroded by family members whom you may consider to be untrustworthy

- Protect assets from creditors

- Benefit both family members and charities through a single plan

Remember, having a clear and intelligent estate plan can bring you peace of mind and assure that your heirs will get the maximum benefit from your hard earned legacy. Estate planning is an extremely important and practical part of your basic financial planning. It’s certainly not something to be avoided or ignored. At American Wills & Estates, we’ve been handling all of our clients Estate Planning and Probate Estate Administration needs with competency, compassion and care for over 25 years. Call us today to schedule your free legal consultation and have a safe, healthy and happy 2016.